Power bills are a shock to the system

CRISPIN HULL COLUMN

I have been pushed over the edge – by the Government and the energy companies. The first monthly electricity bill for the new financial year has arrived. After months of zero bills, this one was for $200.

It came electronically so there was not even the back of an envelope upon which to calculate what has happened and what to do about it.

In short, the Federal Government has stopped its general subsidy. The energy company has slashed payments for electricity feed-in from our rooftop solar and it has jacked up its connection fee by more than five times the inflation rate.

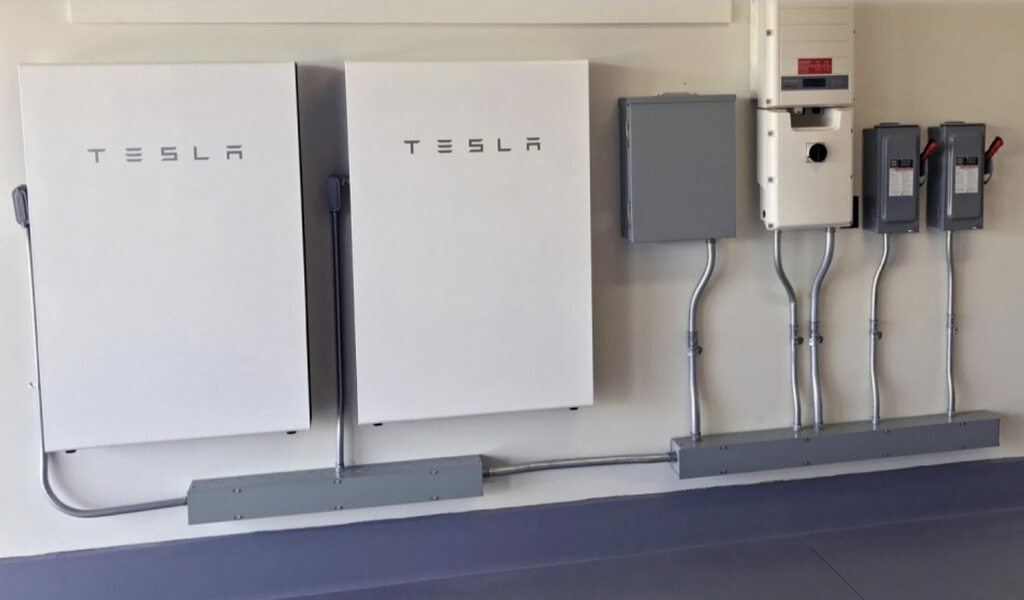

What is to be done? Spoiler alert! Being pushed over the edge means it is time to get a battery. And this is exactly why the Government and energy companies are pushing electricity consumers over the edge.

Government subsidies across the board for everyone’s power bill were just a pre-election voter-anger-reducer. As policy it was stupid – it was merely subsidising inefficient, expensive fossil-fuel-generated electricity.

Giving a rebate for about 30 per cent of the cost of a battery is much smarter. And that is what has happened. The combination of the battery subsidy, the end of the general rebate, and lower feed-in tariffs make the economics of household batteries more than viable.

Back to that envelope. A battery would store the electricity now being fed to the grid and being bought by the power companies for an ever-decreasing rate – it is down to one cent a kilowatt hour in some places and about 8 cents at best in others. With a battery the stored power can be used in the house at night instead of using grid power which costs about 30c a kilowatt hour.

It would wipe all but the connection fee off our bill – about $1900 a year. That would be a tax-free dividend. Superannuation funds typically earn 8 percent. A super fund would need $23,750 in capital to earn a return of $1900 a year.

You can buy a humungous battery for $23,750. In fact, you only need to spend at most $12,000 to get the same result, less a government rebate of a tad over $3000. In short, it is very much worthwhile to withdraw money from super to pay for the battery (if you are over 60), or even increase your mortgage if you cannot draw down super without paying tax.

The figures still work for smaller systems. No financial adviser will tell you this because they don’t get commissions on solar investments, but, with the new subsidy, buying a household battery is one of the best investments around.

And it is pretty much future proofed because feed-in tariffs will only go down and subsidised household batteries will become what is known as virtual power plants. VPPs are connected to the internet, and energy companies can draw power from them in peak times up to a limit set by the householder. And they will pay more, a lot more, for it than what they charge householders – probably enough to pay the connection fee.

This is because the companies would otherwise have to pay more expensive peak gas-generated power.

So, let’s move from the individual householder to the national impact.

More than four million households and small businesses have solar arrays, but fewer than 5 per cent of these are connected to storage batteries.

Whenever governments set up incentive, subsidy, or grant schemes Australians are notorious for flocking to them. The four million subsidised rooftop arrays are testament to that. It was similar with first-home-buyer schemes, pink batts, and any number of sport and rural-and-regional grant schemes.

The fear of missing out on a freebie is powerful. Housing grants, of course, were counter-productive. They sucked money into the housing market and drove up prices putting housing even further away from the very people the schemes were supposed to help.

Rooftop solar subsidies, on the other hand, have been more than useful. Rooftop generates about 12 per cent of Australia’s electricity – about a third of all renewable energy generated. The feed-in subsidies have sucked in a lot of small, private investment, obviating some of the need to generate dirty power.

About half of rooftop generation goes back into the grid. The trouble is that it is happening in the middle of the day when electricity demand is relatively low. At times renewables produce enough electricity to meet all the demand, leaving coal-fired power stations ticking over, producing next to nothing.

There is now so much solar in the middle of the day, that energy companies often do not need it and are no longer willing to pay much for it.

Energy companies could build their own batteries. But that is a big capital outlay and the electricity has to be transmitted to households. The energy sector is already facing resistance from people who live near proposed solar arrays, wind farms, and associated new transmission lines.

That is not helped, of course, by ideological and greedy fossil fuel interests, using any argument, no matter how shallow, to denigrate renewables.

It is going to be much easier for the energy sector to attract masses of small private investors to store power right where and when it is needed – in households and to a lesser extent businesses when the sun is not shining brightly and the wind is gentle.

As that happens the energy companies will be less reliant on expensive gas generation to cover peak loads or coal to cover what used to be called baseload power. Instead, those loads will be covered by household batteries.

Once those four million households (plus 300,000 new solar systems a year) start getting batteries, within a few years expensive unreliable coal power can be phased out.

Coal power stations do not store power that can be tapped into instantaneously. Coal’s so-called baseload means that coal power stations have to have their furnaces burning and some of their turbines running continuously and be generating power continuously, turning on and off extra turbines according to demand.

As coal’s percentage of electricity demand falls and the stations age and become less reliable, that concept of “baseload” becomes unsustainable. And building new coal power stations is now uneconomic when it faces cheaper renewables with battery back-up.

The Government’s $2.3 billion scheme will underwrite about seven million household and small business batteries. They will store the equivalent of what Australia’s coal-fired power stations produce in six months.

This scheme is an unstoppable game changer that, combined with other measures, will end coal-generated electricity in Australia much sooner than predicted.

This article first appeared in The Canberra Times and other Australian media on August 12.

www.crispinhull.com.au

*Crispin Hull is a distinguished journalist and former Editor of the Canberra Times. In semi-retirement, he and his wife live in Port Douglas, and he contributes his weekly column to Newsport pro bono.

The opinions and views in this column are those of the author and author only and do not reflect the Newsport editor or staff.

Support public interest journalism

Help us to continue covering local stories that matter. Please consider supporting below.