All I want for Christmas is…A tax deduction

INDUSTRY UPDATE

Call me an accountant but I take genuine pleasure in securing tax deductions for my clients. However, there’s a common misbelief among many businesses that simply hosting any party or buying any gift will effortlessly earn them a tax deduction from the Australian Taxation Office (ATO) in the name of spreading Christmas cheer.

I quite often hear the argument “But it’s for my employees, it’s great for morale and building relationships to help my business succeed”.

While I wholeheartedly agree with these sentiments, it’s crucial to understand that tax laws are primarily designed to avoid subsidising such costs by allowing a tax deduction and GST claim.

The key distinction for business owners to grasp is the difference between what qualifies as entertainment and what constitutes a gift, as the outcomes vary significantly.

ENTERTAINMENT

The following is considered to be entertainment:

- Restaurant meals/drinks

- Meals/Drinks at your business premise (in the context of a Christmas party)

- Tickets to events/tours

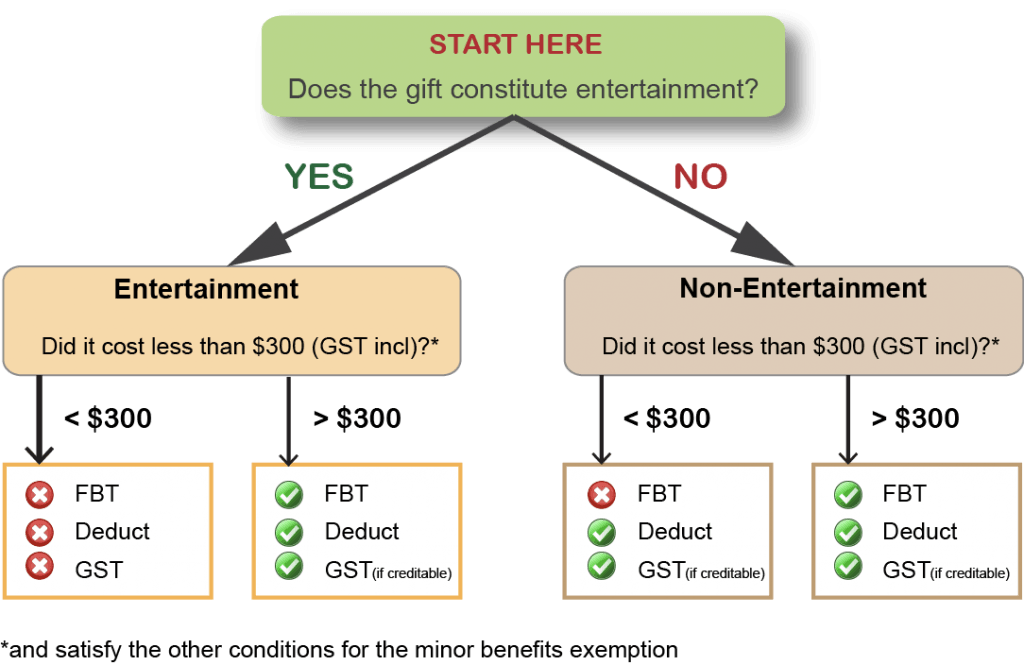

To determine the tax outcome of providing the above gift, you need to establish if the entertainment provided is valued less than $300 (GST inc).

If so, you do not need to pay Fringe Benefits Tax (FBT) to the ATO, however, you cannot claim a tax deduction and cannot claim GST.

If the value is greater than $300, you’ll need to lodge an FBT return to the ATO to pay Fringe Benefits Tax, claim a tax deduction and claim GST.

However, this may not be a desirable outcome as the FBT paid may outweigh the tax and GST savings, necessitating extra work from your accountant.

GIFTS

The following is considered to be a gift

- Christmas Hampers

- Alcohol (unopened and not consumed in an entertainment context)

- Gift Vouchers

- General retail items such as flowers, household items, personal coffee cups, etc.

To determine the tax outcome, you again need to establish if the gift provided is valued less than $300 (GST inc).

If so, you do not need to pay Fringe Benefits Tax (FBT), HOWEVER, you CAN claim a tax deduction and CAN claim GST.

If the value is greater than $300, you’ll need to lodge an FBT return to the ATO, pay Fringe Benefits Tax, and can then claim a tax deduction and GST. Similar to entertainment, this may not be a desirable outcome due to potential outweighing costs.

So, while I strongly believe the staff Christmas party is an essential part of a business’s social calendar, if you aim for a tax/GST benefit for your generosity, a gift under $300 is your best option.

As my clients would tell you, I love using drawings and flowcharts to explain myself. Therefore, here’s my Christmas gift to you:

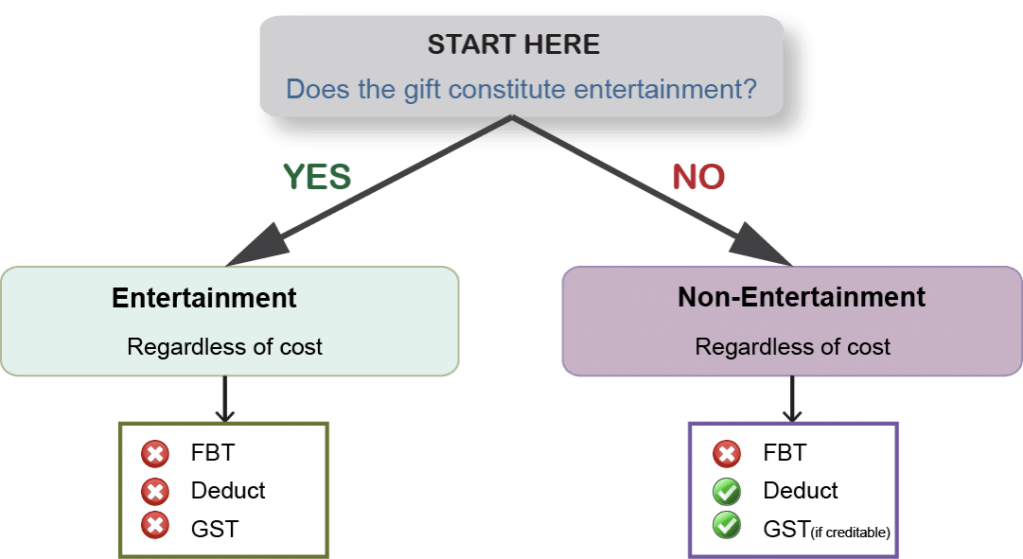

The ATO has a slightly different view when it comes to entertainment and gifts to third parties E.g. Clients, Supplier, Contractors, etc

Entertainment, regardless of the cost, will not attract FBT and NO tax deduction or GST claim can be made.

Gifts, regardless of the cost, will not attract FBT HOWEVER, a tax deduction and GST claim CAN be made.

This advice is general in nature. You should consult with your accountant for clarification in regard to your specific circumstances.

Thank you!

Newsport thanks its advertising partners for their support in the delivery of daily community news to the Douglas Shire. Public interest journalism is a fundamental part of every community.

Got a news tip? Let us know! Send your news tips or submit a letter to the editor here.

* Comments are the opinions of readers and do not represent the views of Newsport, its staff or affiliates. Reader comments on Newsport are moderated before publication to promote valuable, civil, and healthy community debate. Visit our comment guidelines if your comment has not been approved for publication.