Douglas median home values down, but still higher overall

HOME VALUES

Signs are showing that growth in home values in the Douglas-Daintree region is starting to flatten out.

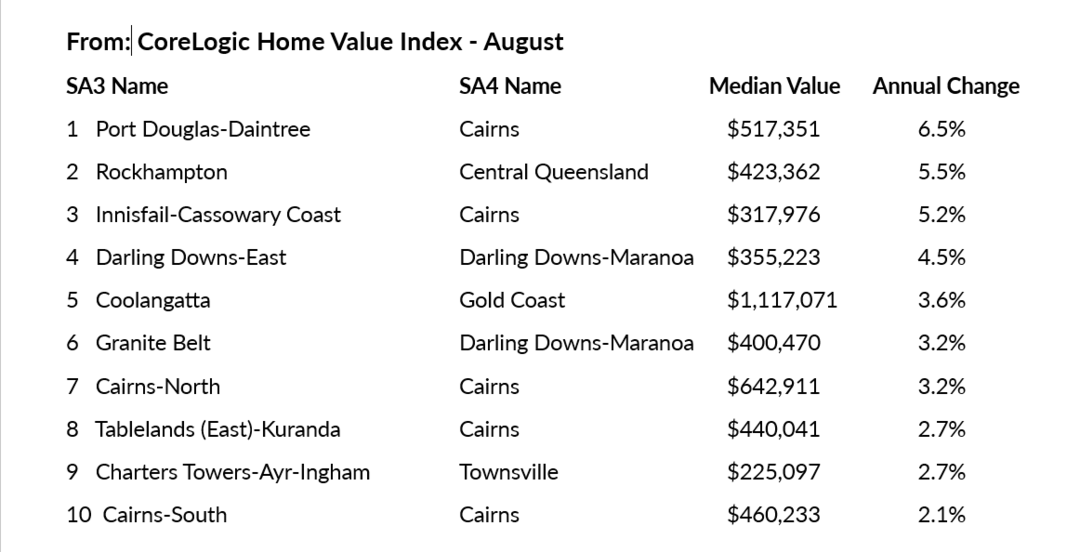

The latest home value report by key national research firm CoreLogic revealed the median home value in Douglas in August was back down to $517,351 – an almost 4.9 per cent drop from April’s median value for the region of $543,351.

While the decrease appears significant, it is important to remember that the ‘median value’ only reflects the sale price of the ‘middle’ home in a list of properties ranked from highest sale price to lowest, over a set period of time (in this case, four months).

Despite the drop, the 12-month increase in median home value to August remained higher in Douglas-Daintree than all of the rest of regional Queensland – at 6.5%.

The median value amongst all of the regional areas of Queensland combined, was $577,631.

CoreLogic noted that with housing values trending higher over the past six months, it was clear that national housing recovery was “firmly entrenched, albeit with some diversity from region to region,” its report said.

“Of the 85 SA4 sub-regions nationally, 65 or just over three quarters, recorded a rise in home values over the three months to August,” it added.

Although housing values are broadly rising, CoreLogic said there are a few factors – or ‘headwinds’ – that will remain apparent looking forward.

These will include closely monitoring rising stock levels, a subtle rise in total listings in some regions, which has supported a deceleration in value growth, and more property listings in the traditional spring and summer months.

Consumer spending will also be a factor to watch.

“Buyers continue to face hurdles in accessing the housing market especially from a credit perspective,” CoreLogic said.

“Lending to borrowers with small deposits or high debt levels relative to their income has become an increasingly smaller portion of home lending.

“Additionally, borrowers continue to be assessed to service a new loan three percentage points above the current mortgage rate. For many borrowers this means demonstrating an ability to repay their loan at a mortgage rate of more than 9%.”

Ongoing low “consumer sentiment” is another factor dampening home buying activity, as well as forecasts that interest rates are unlikely to reduce until well into 2024, increasing the likelihood that more households will face mortgage stress.

“The most recent data has continued to show mortgage arrears remain only slightly above record lows, however the portion of borrowers falling behind on their mortgage repayments is likely to rise through the second half of the year and into 2024.

“This risk increases as more borrowers navigate the transition from low fixed home loan rates to substantially higher refinanced rates.

“On the flipside, there are a range of tailwinds that should help offset these downside factors. With inflation reducing faster than forecast, cost of living pressures are becoming less significant and the risk of higher interest rates has subsided.

“The combination of lower inflation and a growing expectation that interest rates have peaked should gradually boost consumer sentiment, helping to support high commitment decision making such as buying or selling a home.”

https://queenslandsothebysrealty.com/1P3520/350-port-douglas-road-port-douglas

Thank you!

Newsport thanks its advertising partners for their support in the delivery of daily community news to the Douglas Shire. Public interest journalism is a fundamental part of every community.

Got a news tip? Let us know! Send your news tips or submit a letter to the editor here.

* Comments are the opinions of readers and do not represent the views of Newsport, its staff or affiliates. Reader comments on Newsport are moderated before publication to promote valuable, civil, and healthy community debate. Visit our comment guidelines if your comment has not been approved for publication.