CYCLONE CLAIMS: $45M Jasper insurance bill in Douglas Shire

CLAIMS PAID

Insurance policyholders in Douglas are hoping for minimal increases in their premiums despite the revelation that $45-million in claims have been paid as a result of Cyclone Jasper and the storm’s subsequent flooding.

In the immediate aftermath of Jasper, there were concerns especially from businesses in Mossman that post-cyclone flood claims would not be covered and therefore not paid.

Some have received or are expected to receive national disaster relief funds if insurance did not cover their losses.

But the Insurance Council of Australia (ICA) has told Newsport the rate of declined insurance claims has not been any higher than that of “recent declared insurance catastrophes.”

Insurance companies received 1,300 claims from policy-holders in Douglas Shire – amounting to a total of $45-million in payouts.

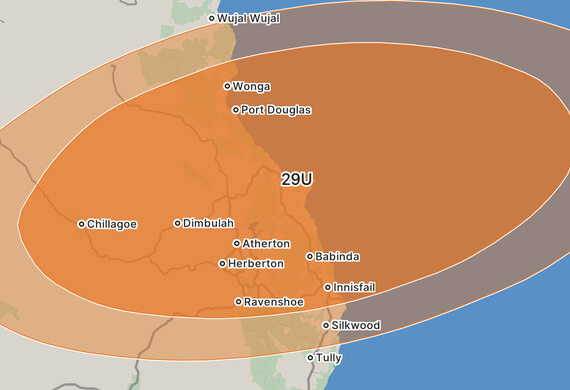

The ICA said insurers received close to 10,000 claims totalling around $296 million from across the ex-Tropical Cyclone Jasper impacted regions, including Douglas, from 10 to 16 December 2023.

“Of the close to 10,000 claims, 192 (two per cent) were declined, although we do not have the breakdown for the Douglas Shire Council LGA,” the spokesman said.

“This percentage of declines is in line with other recent declared insurance catastrophes.”

Cyclone Reinsurance Pool

The insurance industry has yet to ascertain whether the newly-enacted Cyclone Reinsurance Pool – introduced by the previous federal government – will bring any cost relief to insurance premiums.

In recent years, home and business owners’ insurance premium rises have occurred more often due to the bigger scales of natural disasters across the country, as well as rising costs for building and repairs.

The Reinsurance Pool – a type of insurance for insurance companies – was supposed to help alleviate the costs in northern Australia, where most cyclones strike.

“The Cyclone Reinsurance Pool has only been in effect for less than four months and its impact on premiums is still to be fully understood,” the ICA spokesman told us.

Problems were identified not long after it was introduced with the way the Pool was set up, particularly regulations which only allowed a 48-hour damage period, after which time properties were not covered by the reinsurance pool.

But the current government has started a review into the Pool.

“The Commonwealth Government has made a commitment to review the Pool, and the Insurance Council and insurers look forward to participating in that process when that happens,” the spokesman said.

“In January 2024, the ICA and insurers participated in the insurance roundtable led by the Assistant Treasurer following Ex Tropical Cyclone Jasper, and recently participated in hearings to support the Joint Select Committee on Northern Australia on the Cyclone Reinsurance Pool,” he added.

“The ICA will continue to work with government and industry partners to help improve the insurance outcomes for customers.”

Support public interest journalism

Help us to continue covering local stories that matter. Please consider supporting below.