Premier shopping strip in need of a little retail therapy

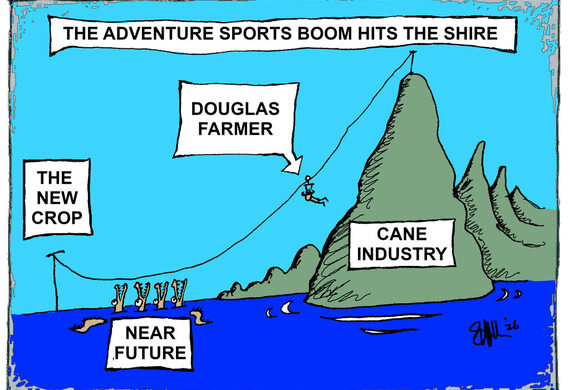

Shire industry

The chief executive of the Australian Retail Association is calling for more to be done to even out the retail playing field as bricks-and-mortar shops continue to close across the country, including in Douglas Shire.

In the wake of the recent closure of at least six retail shops in the Port Douglas shopping strip, ARA chief executive Chris Rodwell told Newsport last week cheap online shopping and the high cost of living were impacting everywhere.

“Ultra-cheap platforms like Temu and Shein are pushing many local retailers, especially smaller and mid-sized businesses, to the brink because they simply can’t compete with cheaper imports,” Mr Rodwell said.

“While local retailers welcome competition, this is not a level playing field.

“The retailers that back Australia create local jobs, contribute taxes here and are committed to safety, anti-slavery, and sustainability.

“It’s critical the government and regulatory agencies hold all retailers to the same standards.”

An ARA small-business focus group late last year also found the cost-of-living crisis meant customers were cutting back on discretionary spending and focusing only on essentials, fundamentally impacting business viability and profitability, he said.

Other Douglas Shire residents spoken to by Newsport have also placed some of the blame on “greedy landlords” driving shop owners out with unnecessary rent hikes.

But the shop owners spoken to by us gave a variety of different reasons for closing their doors.

One said they were closing to return to study, while another said they only intended to be open for three years, and that time frame was now up.

The Port Douglas CBD retail shops to close recently include Millie and Me, Tahitian Lime, Sportscraft, Bahnuk, Jay Jays and Happy Herbs.

The most recent Australian Bureau of Statistics data shows, while the number of businesses across the country grew last financial year, retail was one of only two sectors which shrunk significantly.

The number of Australian businesses grew by 2.5 per cent in the 2024/25 financial year, with sole traders and large corporations the main areas of growth, according to the ABS figures.

The figures, however, paint a mixed picture, with close to 430,000 new businesses starting up, but more than 370,000 closing down - a churn rate of about 30 per cent.

Australia had about 2.7m businesses at the end of last financial year, but more than 1.7m of those were sole traders.

“It represents a fundamental shift in how Australians are choosing to structure their working lives, and the trend is accelerating,” according to the ABS.

“Perhaps the most significant finding in the latest data is the decline of small employing businesses.”

The ABS data shows a boom in new businesses after Covid-19, followed by a crash in 2022/23, then a stabilisation from 2023-25.

“The challenging middle ground of 1-19 employees is increasingly difficult territory,” the ABS states.

“Costs are high, complexity is significant, and margins are tight.

“The data suggests businesses need to either stay lean or scale quickly through this range.”

The service economy is the growth sector - such as healthcare, transport, financial services and professional services - while retail, agriculture and manufacturing are either stable or declining.

“We’re seeing more people choose to stay solo indefinitely, enabled by technology and platforms.

“Those who do hire face a much higher bar to make it work economically.”

Healthcare and social-assistance businesses increased by 6.6 per cent compared to the previous year, while the industries with the largest decrease were retail, with a drop of 0.4 per cent to about 156,000 businesses, and agriculture, forestry and fishing, with a decrease of 0.8 per cent to about 171,000 businesses.

A KPMG report from the end of the 2025 financial year found, however, visitation to shopping centres has been climbing steadily despite the higher cost of living.

This trend has led to steady year-on-year increases in income and trade for the retail sector, the report found.

“The outlook for retail sales continues to improve as some of the pressures on household budgets start to ease,” it reads.

But total returns for the retail sector remain low at 3.7 per cent as shop owners continue to invest in more capital.

Deloitte Access Economics forecasts retail sales growth of 2.3 per cent in 2026 and 2.6 per cent in 2027.